how to check unemployment tax break refund

I figured it was probably a neighbouring door bc I have mistaken a neighbours door opening for someone opening mine but never has been the case. The HR Block Newsroom.

1099 G Unemployment Compensation 1099g

It is not your tax refund.

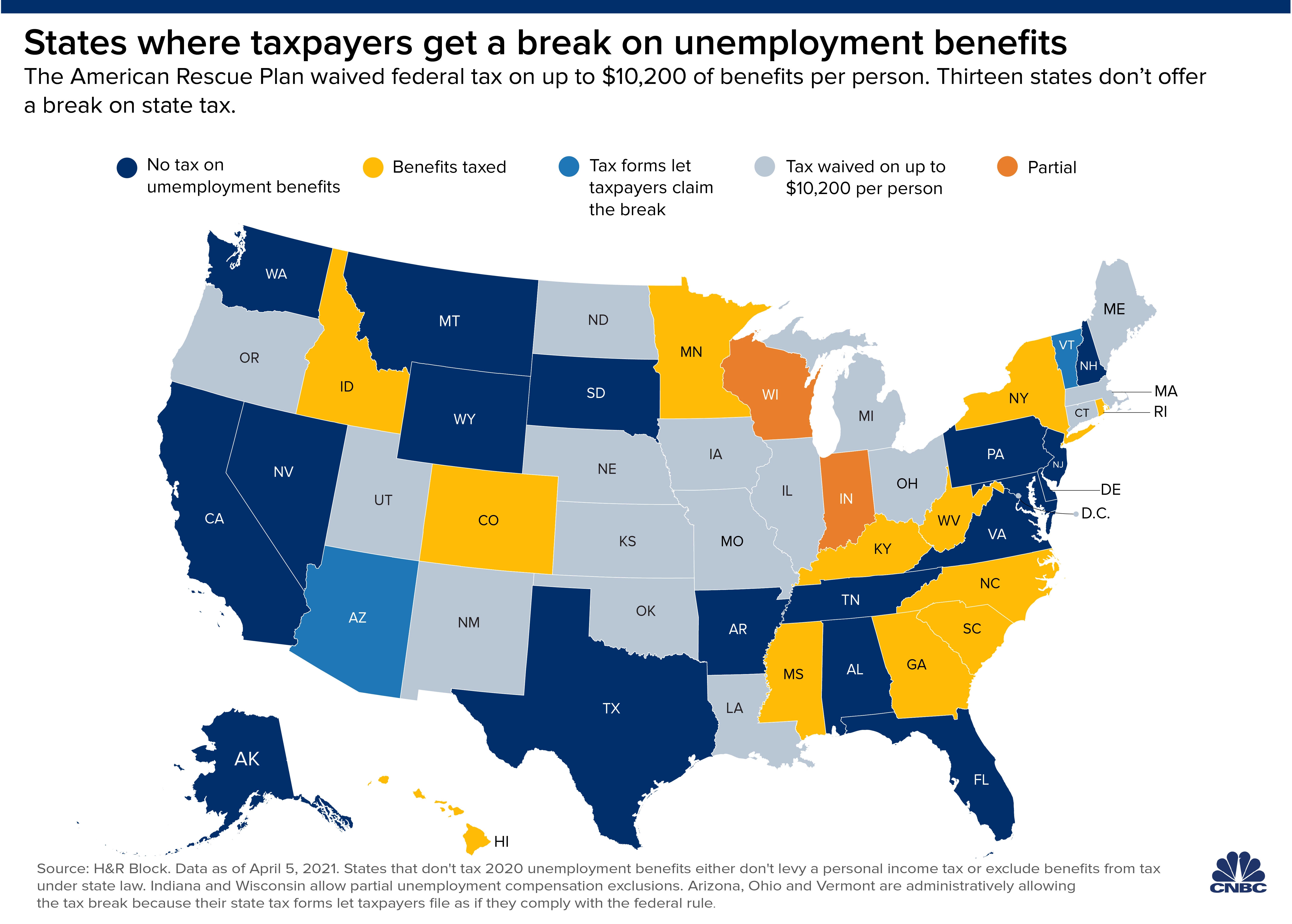

. Big Blue Interactives Corner Forum is one of the premiere New York Giants fan-run message boards. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

You may also see TAX REF in the description field for a refund. Food for thought at Thanksgiving. This ensures all instructions have been followed and the work submitted is original and non-plagiarized.

Did you receive a letter from the IRS about the EITC. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. We offer assignment help in more than 80 courses.

Payments for services of a parent are subject to income tax withholding social security taxes and Medicare taxes. If the business is a corporation even if controlled by the child a partnership even if the child is a partner or an. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

This is an optional tax refund-related loan from Pathward NA. Unemployment Tax Guide Student Tax Guide Gig Worker Tax Guide. Fastest tax refund with e-file and direct deposit.

However some taxpayers who typically do not file returns will need to submit a simple tax return to receive the economic impact payment. You may claim the EITC if your income is low- to. It is not your tax refund.

Unemployment government benefits and other direct deposit funds are available on effective date of settlement with provider. October 17 2022 is the deadline if you requested an extension. Tax refund time frames will vary.

Congress hasnt passed a law offering a. Tax refund time frames will vary. Get the latest science news and technology news read tech reviews and more at ABC News.

Tax filers with adjusted gross income up to 75000 for individuals and up to 150000 for married couples filing joint returns will receive the full payment. Get your tax refund up to 5 days early. For 2021 the standard deduction increased to 12550 for single filers and 25100 for married couples filing jointly.

When its time to file have your tax refund direct deposited with Credit Karma Money and you could. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund. Try it for FREE and pay only when you file.

Standard deduction increase. Check For The Latest Updates And Resources Throughout The Tax Season. The IRS issues more than 9 out of 10 refunds in less than 21 days.

The Check-to-Card service is provided by Sunrise. Get your tax refund up to 5 days early. This is an optional tax refund-related loan from Pathward NA.

Most religious people consider the Earth sacred and believe God gave us a duty to protect our oceans forests and clean air. You must file a federal income tax return to get a refund of this tax. TurboTax online makes filing taxes easy.

We have an essay service that includes plagiarism check and proofreading which is done within your assignment deadline with us. Breaking News First Alert Weather Community Journalism. NW IR-6526 Washington DC 20224.

Compare read discuss and be a Money Saving Expert. Who is eligible for the economic impact payment. The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income.

April 18 2022 was the big tax deadline for all federal tax returns and payments. Choose easy and find the right product for you that meets your individual needs. Find out what to do.

Martin Lewiss free site saves you money. I then hear a door open. However because you received unemployment benefits during the same period 300 was deducted from your initial benefit payment.

We welcome your comments about this publication and your suggestions for future editions. The Check-to-Card service is provided by Sunrise Banks. Fastest tax refund with e-file and direct deposit.

Payments for services of a parent are not subject to FUTA tax regardless of the type of services provided. Making a tax payment. Ways to check on the status of your refund.

What if I cant pay now. TurboTax is the easy way to prepare your personal income taxes online. Loans are offered in amounts of 250 500 750 1250 or 3500.

Loans are offered in amounts of 250 500 750 1250 or 3500. What are the unemployment tax refunds. Three experts share what they think will happen next with Bidens forgiveness plan and.

Set us as your home page and never miss the news that matters to you. Someone was opening my apartment door at nearly 1am. Beat the system on credit cards shopping special offers mortgages council tax interest rate payments freebies loans loopholes best buys.

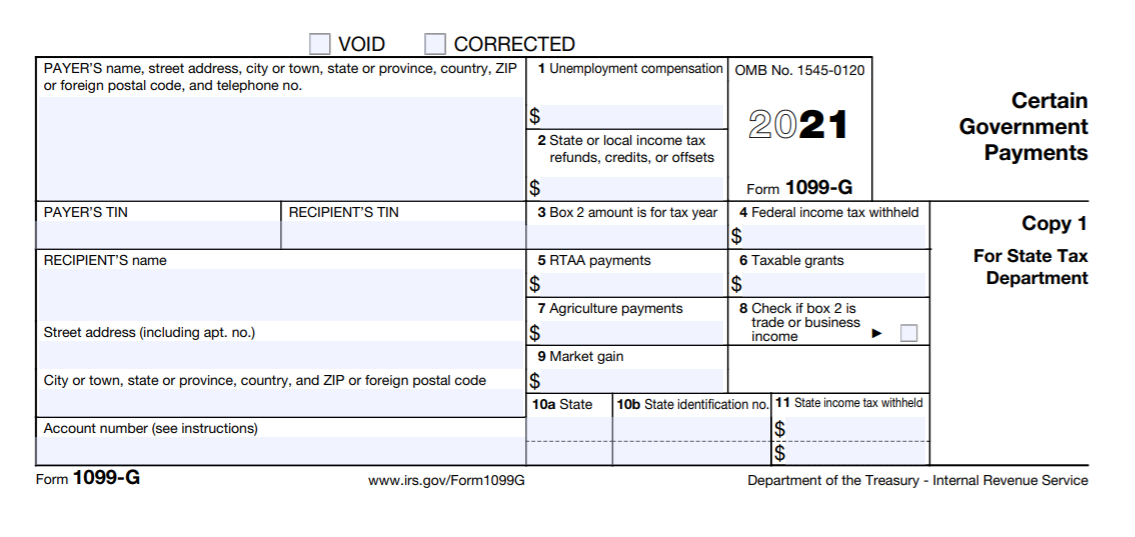

E-file online with direct deposit to receive your tax refund the fastest. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Box 9Net Tax Withheld During 2021.

This time the sound was louder so i turned around just to check to make sure it isnt my door but it fucking was. When its time to file have your tax refund direct deposited with Credit Karma Money and you could. Join the discussion about your favorite team.

This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. Fastest refund possible. Whats Next for Bidens Student Loan Forgiveness Plan and How to Prepare for Anything.

We offer assignment help on any course. The IRS issues more than 9 out of 10 refunds in less than 21 days. Tax filing deadline.

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

Unemployment 10 200 Tax Break Some States Require Amended Returns

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Pennsylvania Department Of Revenue Announces 1 Month Extension To File 2020 Income Tax Returns Fox43 Com

When Will Unemployment Tax Refunds Be Issued King5 Com

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

States Seek Amended Tax Returns For 10 200 Unemployment Tax Refunds

Dor Unemployment Compensation State Taxes

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

What You Should Know About Unemployment Tax Refund

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

10 200 Unemployment Refund Check Status How To Check Your Unemployment Refund With The Irs Youtube